Small Business

Loans to Empower

Your Growth

Clear Skies Capital offers fast and flexible small business loans designed to help your company grow. Whether you need funds for expansion, equipment, or daily operations, we make financing simple so you can stay focused on success.

Easy Application Process

Secure the Funds You Need for Your Business Growth

Why Choose Clear Skies Capital for Small Business Loans

Easy Application Process

We offer a convenient online application process for all our small business loans, making it simple to apply from anywhere at any time.

Fast Approval Process

Get your approval in as little as 4 hours through our streamlined underwriting process.

Flexible Repayment

Customized repayment plans designed to meet your specific needs and cash flow requirements.

Quick Funding

Get funds within 24 hours of approval for your small business loans!

Your Complete Guide to Small Business Loans and Loan Financing

Small businesses have always been the backbone of the economy. After all, they employ almost half of the country’s workforce and comprise 99.8% of the total businesses in California. Yet, they are also underserved and overlooked when it comes to accessing small business loans. For example, when they need a line of funding, banks and financing institutions typically force them to jump through hoops with voluminous requirements and high-value collaterals.

But before we start, we must define “small.”

What classifies as a Small Business?

The government casts a relatively wide net in its definition of “small”. For instance, your company is included in this category if you employ less than 500 workers. So, over 99% of the businesses in California, or nearly four million, are categorized as “small.” However, they are responsible for more than seven million jobs, or roughly half of the workforce.

Small and medium businesses (SMBs) with fewer than 100 employees make up a third of the seven million jobs, demonstrating their crucial role in the economy.

It’s widely known that the odds are stacked against SMBs in America when it comes to securing small business loans, as 20% of them will fail in the first twelve months for lack of funding. About a third will fold in their second year, and half will close shop by the fifth year. Finally, only 30% of the SMBs will have enough cash to survive their tenth year.

The Small Business Administration is a government agency that seeks to create an environment for SMBs to survive. However, according to the SBA, one significant handicap is their inability to get business loan application approval.

The industry the SMBs belong to will also determine the first-year failure rate:

- Construction and transportation companies have a failure rate of 25% for the first year

- Healthcare companies have a failure rate of about 20%

- IT companies have a failure rate of 25%

- Mining and quarrying companies also have a failure rate of 25%

- Restaurants have a failure rate of 20%, and the percentages are shrinking over the years, which debunks the myth that they have the highest turnover ratio

So, these are the same companies that badly need help in terms of small business loans. Yet, lenders are reluctant to help because they are considered risky.

Top Reasons Why Small Businesses Fail (Hint: It’s Not Only About Small Business Loans)

But why do they fail?

People quickly judge that small businesses couldn’t hang with the big boys or that they were way over their heads. Opening your own company is not for the weak of heart, so we would never knock anyone for trying. However, there are realities on the ground that they have to face. Small business owners have to surmount one challenge after the other to keep their heads above water.

Lack of Financing

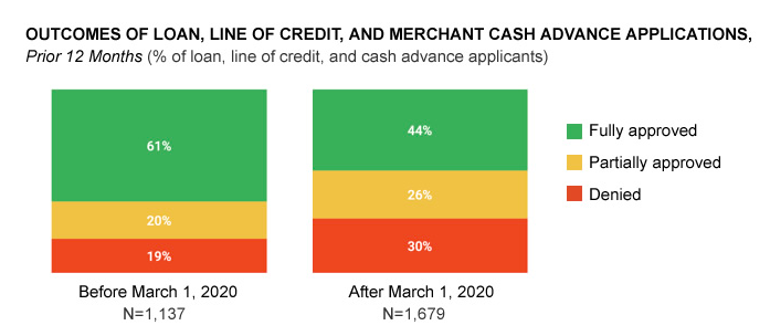

A study by the Federal Reserve revealed that more than 6 in 10 companies do not even apply for small business loans for fear that the financial institution will deny their application. And for those who tried to submit their financing request, about 3 in 10 were eventually rejected, while another 26% received a smaller term loan than they initially requested.

We would not belabor the point about the need for financing for salaries, operational costs, utilities, marketing, and even expanding their business.

Bad Management

Apart from the lack of access to small business loans, a company fails due to the poor business acumen of the owner. Passion will only get you so far, especially when you realize that the competition proves to be stiffer than you initially thought.

In most instances, the owner is spreading themselves too thin since they are doing everything. Perhaps it’s more beneficial to invest in an experienced management team to handle day-to-day operations.

Expanding Too Rapidly

After getting small business loans, some companies open new branches too quickly without first considering market forces. In most cases, these businesses generate a lot of buzz from their product or marketing campaigns.

However, what works for one location may not work for another, mainly because customers have a notoriously short attention span. As a result, they have to deal with secured business loans with disadvantageous terms and hefty insurance costs.

Location Challenges

Sometimes, failing to secure small business loans all boils down to where you set up the business. Some businesses jump head-on without conducting a thorough market study, thinking their product alone will draw in customers. Similarly, locations with high foot traffic usually command premium rent prices.

Risky Industry

Sometimes, it’s not even your fault. If you belong in an industry that banks consider dangerous, it does not matter how quickly you learn to compete since the bank will still cut off access to cash. Since you cannot shift industries, the next best thing is finding a lender willing to take the risk with you.

The US Bank has pointed out that cash-flow problems are the primary reason why 8 in 10 SMBs fold up.

And this is where Clear Skies Capital can help with our diverse range of small business loan products that we will tailor to fit your needs. We also guarantee friendly terms for our different kinds of business loans with interest rates spread over months to avoid saddling you with more debt.

Why Are Small Businesses Loan Applications Rejected?

As we already mentioned, the lack of access to funding is one of the primary causes of failure. But why are banks wary about extending small business loans to small businesses?

Inadequate Documents

When you apply for a job vacancy, you must ensure that you have an extensive résumé to persuade the employer to hire you. It’s the same concept when you apply for small business loans. You must submit complete documents, including:

- Company registration

- Business and marketing plan

- Bank statements

- Income and debt statements

- Payment proposal

The lender could also ask you to present more documents, which you should be prepared to supply.

Incomplete Data

Concerning the first point, you need to give the bank all the necessary information surrounding your business. The bank will never provide you with small business loans if you cannot present a concrete recording system that proves you are in the best position to pay back your obligation.

Unsatisfactory Collateral

Most banks demand collateral for the cash they extend to any company. In almost all cases, the collateral requirement is more valuable than the granted loan, which puts the business in a bind when they default on their payments. Sadly, bank rules are rigid regarding the collateral requirement regardless if you try to convince them to the best of your ability.

Bad Credit Score

Banks look at your ability to pay before deciding whether to lend you small business loans or not. For instance, according to the NSBA, financial institutions reject 20% of applications outright because they could not reach the minimum credit score.

Essentially, reporting bodies like Equifax, D&B, Experian, and FICO will generate the scores that will serve as the basis for banks in making decisions. The score details your operations, debts, and payment history. For example, your score is poor if it ranges between 500 and 600, while it’s considered fair if you rate it between 601 and 660. Similarly, if the owner has a poor track record, it will also reflect on the business, discouraging banks from providing funding.

A more concerning survey, however, is that a whopping 45% of businesses were not even aware of the credit scoring system in the first place.

But it’s not hopeless if you do not exceed the benchmarks of the credit reporting agencies. Clear Skies Capital can help you secure small business loans even with a poor credit record!

Small Business Loans in 2025: How SMBs Deal With Bad Credit Score

How can a small business get loans for beginners?

It won’t be time to panic, even if you have a poor credit record. Even if banks likely reject your unsecured business loan applications, you can turn to lenders that will extend financial support.

The trick is to show them your best practices to persuade them to extend the small business loan amounts you need. Some approaches you can take to apply for small business loans with your current credit standing include:

Find a Co-Maker Who Will Guarantee Your Loan

It takes enormous trust for someone to become a co-signer for your small business loans because they would take on the debt in case of a default. In most instances, business owners turn to family members and close relatives with more financial means to absorb the hit. Of course, the co-maker must have an excellent credit record to increase the likelihood of approval.

Improve Your Business Plan

Another way you can secure small business loans is to refine your business plan and repayment strategy to make them more convincing. The paper must show how you plan on meeting your goals and paying back your obligations. Lenders are more likely to extend you small business loans if they see that your presentation is sound.

Review Your Qualifications

Do not be discouraged by your credit rating since lenders look at other factors when considering small business loans. For instance, your years in the industry will count a lot as they speak volumes about your survival instincts. They will also consider excellent payment records, cash flow, and your existing debt load.

Extend Your Options

Do not let rejection destroy your hopes. If the bank denies your small business loan application, shop around for lenders that are willing to listen. SMBs might be shocked that some lenders are more flexible regarding the applicant’s credit record. For instance, we will tell you precisely what you need to hear to improve your application. In addition, we will help reinforce your weaknesses to ensure that you meet your business goals.

You might have heard “no” so often that you abandoned all hope about getting small business loans with poor credit ratings. However, Clear Skies Capital is in the business of saying “yes” to small business loans.

Best Ways to Improve Your Business Score to Secure Small Business Loans

Constantly Monitor Your Credit Rating

You can obtain your score from the reporting agencies mentioned above. Getting a copy is not free, but it’s vital since you must have a baseline score to determine your position. You should also review all bills and dispute any amount you find erroneous. Finally, work with the lenders to update accounts.

Manage Your Credit Ratio

The rating bodies do not care that you have an outstanding loan since they are more interested in how you manage your ratio when applying for small business loans. If you can keep it under 15%, your status improves, and lenders are more likely to extend you a lifeline. For example, a straightforward way to do this is to ask your credit card company to raise your credit limit.

Keep Track of Your Payments

The lending company will go through your loan and payment history with a fine-toothed comb before they approve your small business loans. If you settle your bills and debts on time, your credit rating will eventually increase.

Admittedly, the process takes some time, and you might not have the luxury of waiting since you need an infusion of capital right now. One trick is to pay off your debts as soon as you have extra money. Don’t wait for the bill to come and then decide only to settle the minimum balance.

Nevertheless, if you do not have the time to improve your standing, you can still apply with us for small business loans even if you have a less desirable credit record. Contact us, and we will tell you how!

Small Business Loans for Women: Empowering Female Entrepreneurs

Women entrepreneurs face unique challenges in accessing business capital. Small business loans for women are specifically designed to bridge the funding gap that female business owners often encounter when seeking traditional financing.

Specialized Programs for Women-Owned Businesses

Small business loans for women often come with:

- Reduced down payment requirements

- Competitive interest rates

- Extended repayment terms

- Additional business mentoring and support services

- Access to women-focused business networks

The SBA Women’s Business Centers provide access to capital and business training specifically for female entrepreneurs. Many state and local programs also include set-asides for women-owned businesses.

Ready to explore small business loans for women? Contact our team today to discuss specialized financing options designed to support female entrepreneurs.

Small Business Loans for Veterans: Supporting Those Who Served

Military veterans possess valuable leadership skills and business acumen that translate well to entrepreneurship. Small business loans for veterans recognize this potential by offering specialized financing programs with favorable terms.

SBA Veterans Programs

The Small Business Administration offers several programs specifically for veterans seeking small business loans:

- SBA Veterans Advantage Program: Reduced fees on SBA 7(a) loans

- SCORE mentoring: Free business counseling from experienced entrepreneurs

- Veterans Business Outreach Centers: Specialized training and counseling services

Benefits of Small Business Loans for Veterans

Small business loans for veterans often feature:

- Waived or reduced origination fees

- Lower down payment requirements

- Expedited application processing

- Access to veteran business networks

- Specialized underwriting that considers military experience

According to the SBA, veteran-owned businesses generate over $1.3 trillion in annual revenue, demonstrating the significant economic impact of supporting veteran entrepreneurs.

Explore our specialized veteran business loans designed to honor your service while supporting your business success.

What Types of Small Business Loans Are Available to You?

Despite a poor credit score, you may still avail of the following small business loans:

Business Credit Cards

You can use credit cards to cover the company’s overhead costs. They have less rigorous requirements for small business loans, and the annual percentage rates will increase to 25%. The interest is based on the balance amount that carries over month-to-month.

Term Loans

This financial instrument will allow you access to a lump sum amount through term loans, and you need to repay it for a specified period. Each term is highly flexible and varies from one lending company to the next. The payment term may range from as short as three months to as long as five to ten years.

Line of Credit

You can draw money up to a ceiling amount from the line of credit. You can withdraw funds as needed through working capital loans, and the interest is based on the money you use. You can opt to pay the amount you borrowed first before you can get another line of funding.

Invoice Factoring and Financing

The factoring vendor can absorb your outstanding invoices in exchange for a lump sum amount. The vendor is now responsible for collecting your receivables while also collecting the factoring fee. In this type of financing, you use these papers as a guarantee to borrow cash. Under this setup, you would still be responsible for managing the debts owed to you.

Microloans

You can receive ready cash for as little as $500 through microloans, but you can borrow as much as $50,000. There are several advantages to applying for microloans. For instance, the requirements are lax, the approval is quick, and the lender does not demand any collateral.

Merchant Cash Advance

Although widely accepted as a business loan, it’s not technically one. Under this setup, you sell a portion of your future income in exchange for a lump sum amount that the lender will give now.

How About SBA Loans?

The Small Business Administration or SBA guarantees the loan extended to small business owners. The agency tries to do this by offering several programs that reduce the risks to the lender, which then convinces them to accommodate the small business loan application.

The SBA loans funding program will make it easier for small companies to receive business financing.

You can choose from any of the SBA loan funding mechanisms:

7(a) Business Loans

This type will cover a portion of the total funding amount, including the limit fees and the ceiling interest rate.

504 Business Loans

You can use this SBA package to get fixed-rate funding to buy or repair equipment financing, real estate, and other business assets.

SBA Microloans

You can secure a line of funding from the SBA guarantee worth $50,000 to kickstart your business. These microloans are the best small business loans for startups, regardless of whether they are run by men, women, or other marginalized sectors.

If you have shopped around and can’t find any funding source willing to extend small business loans, then your best route is to go through SBA loans.

Clear Skies Capital: Helping You Get Small Business Loans for Business Advantage

Unlike other lenders, Clear Skies Capital does not discriminate against companies with bad credit ratings and outright reject their small business loan applications. We also made our online application process quick and simple for companies to apply for funding to get a business advantage.

In fact, we have extended small business loans to businesses given up for dead by banks. We also ensure a seamless application process and quick turnaround when you apply for our business loans. We only need your concrete business plan, so we can assess your ability to settle your small business loans.

Once we think that your concrete plan is viable, you can choose from the following small business loan options:

- Term loans

- Microloans

- Merchant cash advances

- Specialized small business loans

If you are unsure about the kind of small business loan ideal for you, our friendly officers will gladly explain each financial instrument to help shape your decision. Regardless of your choice, we will customize a loan package for you that considers your current financials and future potential. We believe in you even if nobody else does.

How to Apply for Small Business Loans: Step-by-Step Guide

Step 1: Determine Your Funding Needs

Before applying for small business loans, clearly define how much capital you need and how you plan to use it. Create a detailed budget that outlines specific use of funds and expected return on investment.

Step 2: Gather Required Documentation

Most small business loan applications require:

- Business financial statements

- Personal and business tax returns

- Bank statements

- Business plan and use of funds statement

- Legal documents (articles of incorporation, business licenses)

Step 3: Check Your Credit Score

Your personal and business credit scores significantly impact your loan approval chances and interest rates.

Step 4: Research Lenders

Compare different lenders offering small business loans, considering interest rates, fees, repayment terms, and approval requirements.

Step 5: Submit Your Application

Complete your application accurately and thoroughly. Missing information can delay processing or result in denial.

Step 6: Review Terms and Accept

If approved for small business loans, carefully review all terms before signing.

Tips to Improve Your Small Business Loan Approval Chances

- Strengthen your credit profile by paying all bills on time

- Prepare strong financial documentation

- Build relationships with local banks and credit unions

- Create a comprehensive business plan

- Maintain accurate, up-to-date financial records

- Demonstrate stable revenue streams and growth trends

Frequently Asked Questions

What credit score do I need for small business loans?

Most lenders prefer a personal credit score of 650 or higher for small business loans, though some alternative lenders may accept scores as low as 500.

How much can I borrow with small business loans?

Small business loan amounts vary widely based on the lender and loan type. Microloans may offer $500 to $50,000, while SBA 7(a) loans can provide up to $5 million.

How long does it take to get approved for small business loans?

Approval times for small business loans range from 24 hours for online lenders to 30-90 days for SBA loans.

Are there special small business loans for women?

Yes, small business loans for women typically require certification of women ownership (51% or more) and may have additional benefits like reduced fees and extended terms.

Can veterans get special small business loans?

Yes, small business loans for veterans often have more flexible credit requirements and consider military experience in underwriting decisions through SBA Veterans programs.

Can startups qualify for small business loans?

Startups can qualify for certain types of small business loans, particularly SBA microloans, equipment financing, and some alternative lending products.

What’s the difference between secured and unsecured small business loans?

Secured small business loans require collateral, typically offering lower interest rates. Unsecured loans don’t require collateral but often have higher interest rates.

How do I choose between different types of small business loans?

Choose based on your specific needs: equipment financing for purchases, lines of credit for working capital, term loans for expansion, and SBA loans for the best rates and terms.

Are small business loans hard to get?

We have set up a system that makes it seamless for businesses to apply for small business loans. You may go to our application page and provide personal information and details about your business. We guarantee the confidentiality of your information on our highly secure portal. We also do not share private client details with third parties.

After submitting your small business loan application, we will evaluate your papers and reply within 24 hours to brief you on the next steps.

Do not worry. We don’t charge demanding processing fees or documentary charges from our clients to secure small business loans. As a result, the entire application process for business loans is free.

The best part is that you have no obligation to move forward, even if we have already approved your small business loan application. You can back out anytime, and we won’t hold it against you. We are still happy to welcome you with open arms if you want to partner with us in the future for small business loans.

Take Action: Secure Your Small Business Loans Today

Here at Clear Skies Capital, our primary aim is to give you a much-needed lifeline when you feel that everyone else has abandoned you. Whether you need small business loans for expansion, equipment purchases, or working capital, we’re here to help.

Don’t delay any longer! Contact us today for small business loan assistance to get your dream back on track.

Ready to secure the small business loans your business deserves? Apply online now or contact our experienced loan specialists to discuss your financing options.

At Clear Skies Capital, we believe in your success and are committed to providing the small business loans you need to achieve your entrepreneurial goals.